Customer Success Story: Credit Scoring Company

Credit Agency Connects Its Data Silos with TigerGraph

This company is one of the three largest consumer credit reporting agencies. They collect and aggregate information on over 800 million individual consumers and more than 88 million businesses worldwide. The company operates through four segments: U.S. Information Solutions (USIS), Workforce Solutions, International, and Global Consumer Solutions. They offer consumer and commercial information services, such as credit information, credit scoring, credit modeling, and portfolio analytics. In addition, they locate fraud detection and prevention, identity verification, and offer other consulting services like mortgage services, financial marketing, and identity management services.

With TigerGraph’s help, we can link consumer data up to four degrees of separation across multiple silos. TigerGraph’s architecture was the only one that supported our need for up to 1,000 requests per second during peak times, making our analysis faster and more accurate.

Lead Architect | Credit Scoring Company

The Challenge

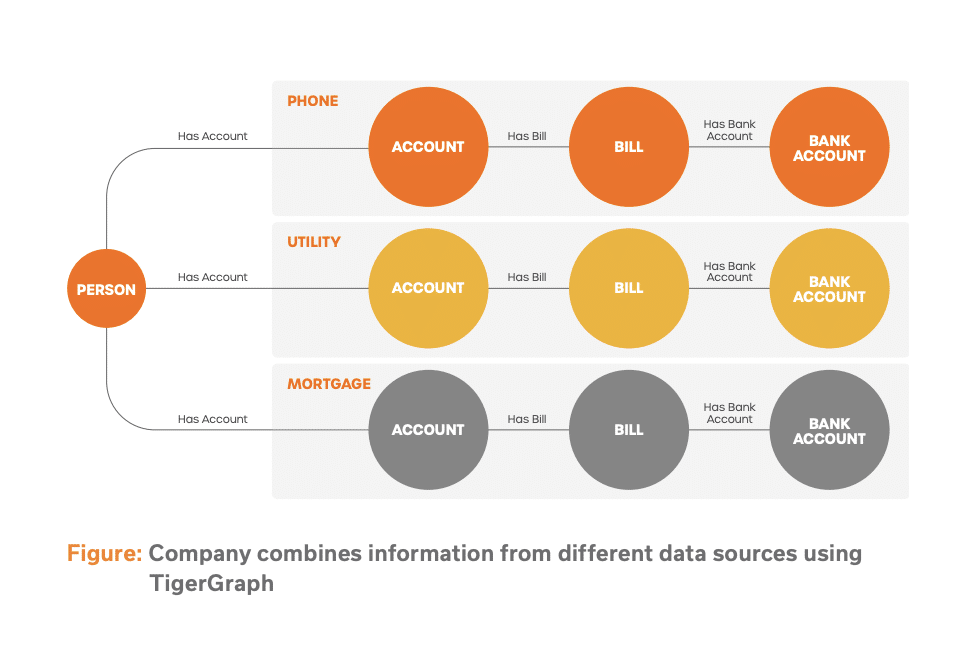

Conducting billions of credit checks annually, this credit reporting agency looked for a more efficient and thorough method to assess a person’s credit history. In their current architectural state, they had multiple data silos by line of business. One of their pain points was that their data centers were segmented by industry. Each time they ran a credit analysis for a person, it didn’t connect to another credit analysis they may have done in the past for that same customer. For example, their credit check system that supported mobile phone companies differed from their mortgage credit check systems, and they needed a solution to link these data silos together without breaking their current functionality.

The Solution

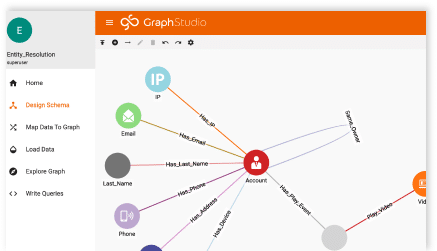

This credit risk company selected TigerGraph after a thorough analysis of Neo4j, JanusGraph, and other database vendors. TigerGraph connects all their data silos by linking a customer to all the credit checks it has for that person. TigerGraph allows the company to develop a data fabric architecture to support their global business—the new fabric enables this company to create new data products in their target markets. TigerGraph’s functionality allows this customer to scale as their business grows, allowing them to have a numerous environment and global rollout, using GCP, which were all business requirements. As a consequence, the company can now combine all their data, remove the silos segmented by industry, and link the same person that may have already been assessed.

The Results

With the power of TigerGraph, the company now makes more accurate credit score predictions. Instead of analyzing each person’s credit score independently, they can cross-link a person’s credit score to other credit scores for that same person but for other major purchases. This company uses TigerGraph to make better credit risk assessments for people already in their database but in other data areas that they previously couldn’t do. The new solution helps their customers, who are using them for credit assessments, make better investments by giving a complete story of the riskiness of the consumer. It also reduces time and effort in their data analysis by comparing relationships between other data sources, not just the segments consolidated from one industry