Bank fraud is a serious concern that affects financial institutions and their customers worldwide. Large organized criminal groups are often the primary perpetrators of fraud, and understanding their tactics is crucial for effective detection and prevention. In this blog post, we will provide a clear and concise overview of bank fraud, its distinctiveness from anti-money laundering (AML), the two main types of fraud (loan and credit card fraud), and how TigerGraph’s detection methods contribute to combating fraud.

Fraud vs. AML: Fraud and AML may appear similar from a data and analytics perspective, but they have distinct commercial implications and are dealt with separately within banks. Fraud involves criminals misrepresenting their identity to steal money from the bank or its customers, primarily resulting in financial losses. AML, on the other hand, focuses on monitoring and reporting money movement to prevent criminals from hiding illicit funds, with non-compliance potentially leading to fines for banks.

Two Types of Fraud: Loans and Credit Cards: Fraud within the banking sector can be broadly categorized into two main types: loan fraud and credit card fraud. Loan fraud typically involves criminals setting up accounts, engaging in legitimate transactions until their credit rating allows them to borrow money, and subsequently absconding with the borrowed funds. Credit card fraud, on the other hand, encompasses criminals either applying for or taking over someone else’s card to withdraw cash or make purchases that can be resold for cash. In both cases, the intention not to repay the borrowed funds or settle the card charges constitutes the fraudulent act.

Detecting Fraud: There are two critical points at which fraud detection becomes crucial: during the application process and at the time of the fraud itself. Detecting suspicious accounts during the application stage involves assessing whether the provided information aligns with known patterns and connections to other suspicious accounts. Detection at the time of the fraud relies on identifying abnormal transaction patterns within the account, often in conjunction with changes in behavior observed in connected accounts.

Detection and Investigation: Fraud detection teams primarily focus on two activities: detection and investigation. Detection aims to identify suspicious accounts and activity through automated means, often utilizing machine learning algorithms. The challenge lies in striking a balance between detecting as much fraud as possible while minimizing false positives and not mistakenly flagging genuine customers as fraudsters. Investigation, on the other hand, involves confirming whether a suspicious account is indeed involved in fraudulent activities. This step typically requires human intervention by trained fraud investigators and can be resource-intensive due to the complexity and volume of transactions associated with fraudulent accounts.

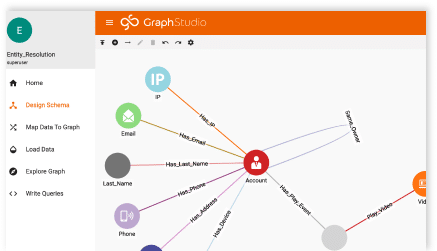

TigerGraph’s Contribution to Fraud Detection: TigerGraph, a leading provider of fraud detection solutions, employs various methods to detect and combat bank fraud effectively. One crucial step is consolidating information to establish connections between accounts and transactions, enabling the identification of suspicious individuals and groups. TigerGraph leverages advanced techniques such as Shortest Path, (Personalized) Page Rank, Louvain Community, and Weakly Connected Components to assess the proximity of an account to known suspicious accounts, determine its centrality in a network, and identify connections to suspicious groups.

Additionally, TigerGraph’s behavioral analysis focuses on monitoring changes in account activity in real-time, both for the account in question and its closely connected accounts. By analyzing transactional behavior and detecting significant changes, TigerGraph’s system can flag potentially fraudulent activities promptly.

Conclusion: Understanding bank fraud is crucial for financial institutions to protect themselves and their customers from significant financial losses. Distinguishing fraud from AML, recognizing the two main types of fraud (loan and credit card), and comprehending the crucial points of detection can aid in implementing effective countermeasures. With its advanced detection methods and focus on consolidating information and analyzing behavior, TigerGraph contributes to the fight against bank fraud, offering financial institutions the tools they need to detect and prevent fraudulent activities in a timely and cost-effective manner.

For more questions, and to connect to our team, please contact us at info@localhost.