It’s no secret that banks are constantly battling a formidable adversary: fraud. And unfortunately, financial institutions continually face staggering losses despite investing billions in sophisticated fraud detection systems.

This blog delves into the pressing issue of fraud in financial services and explores how emerging tech within graph technology is redefining how banks detect and combat fraudulent activities.

Graphs offer the structural capability, speed of response, and scalability to act as knowledge engines for AI threat detection models.

The Scale of the Problem

Fraud is a pervasive problem for banks worldwide. According to a recent report, fraud costs banks over $50 billion annually, despite an investment of $1 billion yearly in fraud detection software.

Fraudsters employ increasingly sophisticated techniques, making it challenging for traditional machine learning (ML) models to keep up. The primary issue lies not in the algorithms themselves but in the data features they utilize.

Understanding Fraud in Banking

Fraudsters target banks and their customers through various means, including transaction fraud, synthetic identity fraud, and elaborate scams. These criminals often operate within large organized networks, making it difficult to identify them through conventional methods.

“Defenders think in lists. Attackers think in graphs. As long as this is true, the attackers win.” – John Lambert, “Defender’s Mindset”

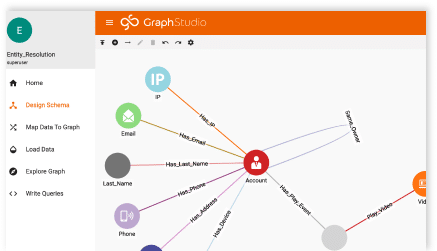

There are two points at which fraud can be detected: between application and fraud and investigation. To detect fraud often the first step is to consolidate information to see all possible connections between accounts and transactions.

Traditional ML models treat each data point as an independent sample, overlooking the crucial relationships between accounts. This is where graph technology steps in.

The Power of Graph Databases

Graph databases have emerged as a powerful tool in the fight against fraud.

Unlike conventional databases that structure data in tables, graph databases represent data as vast networks of interconnected entities. This allows banks to analyze relationships between accounts and uncover hidden patterns indicative of fraud.

Graph databases have structural benefits necessary for threat detection, from analyzing relationships across billions of data points and at ingest speeds to detection analysis via complex queries returning deep hierarchical relationships between data.

Likewise, threat hunting is simplified with a graph database, promoting exploration and identification of patterns or anomalies.

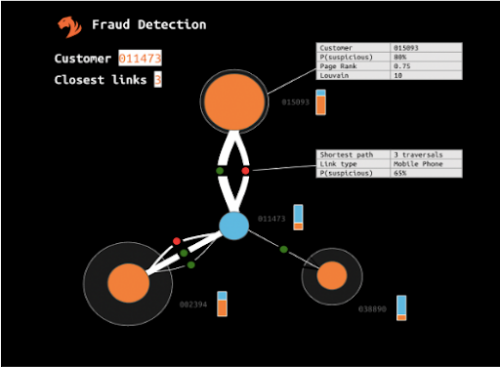

TigerGraph uses graph algorithms to calculate features that reveal the connections between fraudulent accounts. This approach significantly enhances the accuracy of ML models by providing them with new, valuable information.

The following are key algorithms used by TigerGraph in fraud detection:

- Closeness (Shortest Path): An account only a few hops away from a suspicious account is flagged as suspicious.

- Centrality (PageRank): Accounts at the center of numerous connections are considered suspicious.

- Communities (Louvain): Accounts that form tightly-knit communities with known fraudulent accounts are flagged as suspicious.

These graph features and more require minimal system integration, easily merged into an existing fraud detection application.

Real-World Impact

Banking data sets are large, and TigerGraph is the most powerful and scalable graph database, scaling to 100TB on LDBC benchmark tests and partitioning data across servers without breaking vital connections between nodes.

Written from the ground up in C++, TigerGraph is super fast. The following are just some of the impressive results reported back by customers:

- Four Tier 1 U.S. banks have successfully implemented TigerGraph to augment their existing fraud detection systems.

- One bank reported a 20% increase in synthetic identity fraud detection.

- Another reported back that TigerGraph was by far the best technology ROI from their tech investments that year, saying it is saving them $100 million per year.

- JPMorgan Chase inducted TigerGraph into the coveted Hall of Innovation.

By incorporating graph features, these banks have reduced false positives and expedited fraud investigations, enhancing the productivity of their fraud teams and improving customer satisfaction.

Across-the-Board Benefits

- Fraud and Risk Management: TigerGraph dramatically reduces false positives, speeding up fraud investigations, and increasing the productivity of fraud teams.

- Data Science: By providing ML models with additional information on criminal connections, TigerGraph enables significant improvements in fraud detection.

- IT and Architecture: Integrating graph features with existing ML systems is seamless, safe, and quick, without compromising existing architectures.

Conclusion

In the ongoing battle against financial fraud graph technology offers a transformative solution. TigerGraph empowers banks to significantly enhance their fraud detection capabilities by uncovering hidden networks of fraudsters within data.

This reduces financial losses and also improves customer satisfaction by minimizing false positives.

As fraudsters become more sophisticated, banks must leverage advanced technologies like graph databases to stay ahead and protect their assets and customers effectively.

Sign up for a free instance of TigerGraph Cloud at tgcloud.io, or contact us at [email protected] to discover how TigerGraph excels at fraud detection to reduce losses.