Fight Fraud with TigerGraph

Powerful fraud detection software that catches fraud in real-time with advanced machine learning and deep link analytics

Mobile eCommerce fraud costs rose from 5% in 2020 to 39% in 2021

The cost of fraud for U.S. banks is 13% higher in 2021 than before the pandemic

Every $1 of fraud now costs U.S. retail and eCommerce merchants $3.60 in 2021

Fraud is Expensive and Becoming More Prevalent

Fraud is a growing problem in all industries, with eCommerce losses alone exceeding $57.8 billion in 2017. For every dollar involved in fraudulent transactions, the financial services industry spends $2.67 dealing with chargebacks, fees, interest, and labor.

Read More

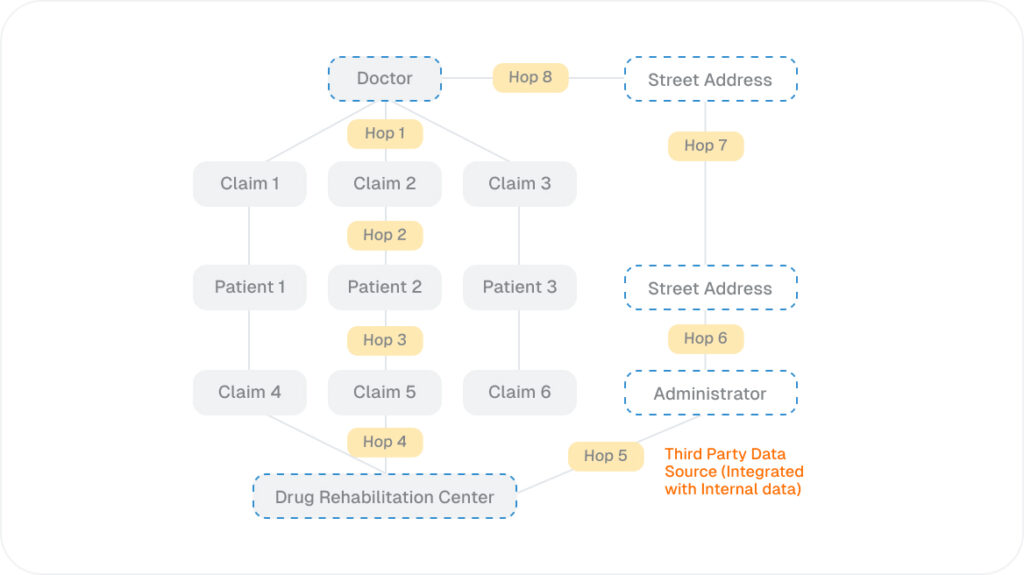

Fraudsters Are Becoming Increasingly Sophisticated

Graph Database, Help Find Fraud?

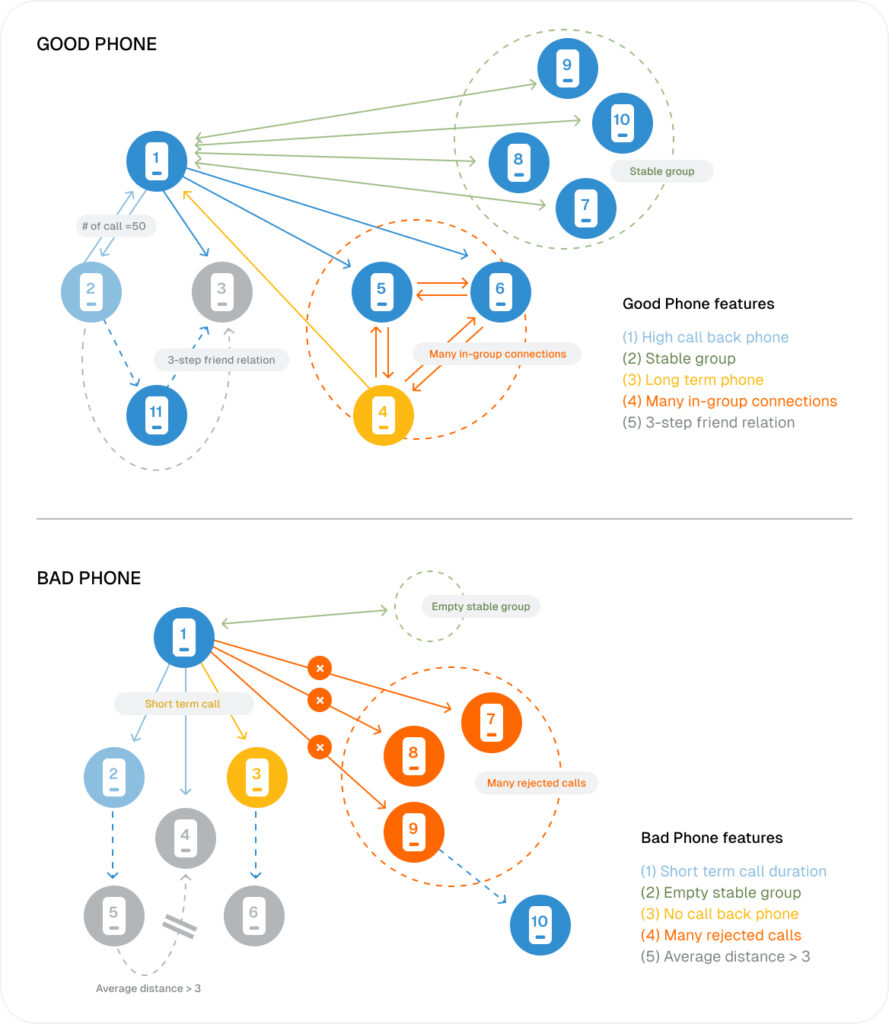

Fraud Detection with Deep Link Analytics

Accelerate Detection with Real-Time Analytics

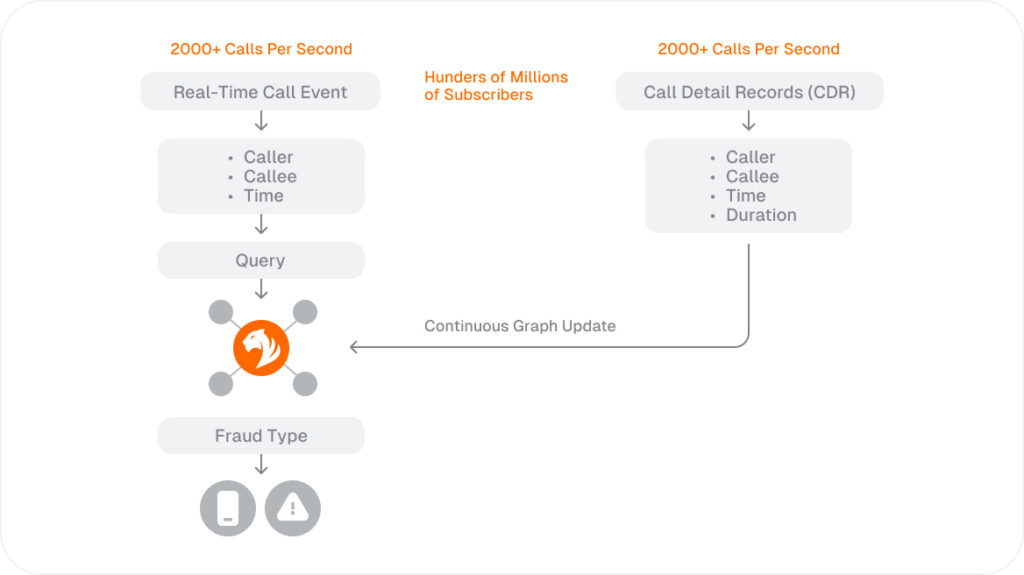

Fraud detection is time-sensitive: every passing minute, hour, and day that fraud goes undetected results in increasing losses for your organization as well as for your customers or citizens. TigerGraph is purpose-built for real-time fraud detection to address this challenge. Let’s consider the example of China Mobile, the world’s largest mobile service provider serving over 900 million subscribers. China Mobile uses TigerGraph to detect phone-based fraud in real-time by analyzing the calling patterns of pre-paid subscribers. Subscribers are alerted in real-time of a potential fraudster call, with high-probability fraud calls being redirected to China Mobile’s call center for investigation.

Read More

Improve Fraud Detection with Machine Learning

Less than 1% of the total call volume for telecom or claims data for healthcare and government benefits or payment transactions for financial services are fraudulent. This means that the machine learning models do not have sufficient training data with confirmed fraud activity to learn and improve their accuracy.

Read More