Detect Money Laundering With TigerGraph

Minimum estimated size of the money laundering globally per year

Cost of AML compliance across the US fin. services sector

AML fine levied against Commonwealth Bank of Australia

Money Laundering Is Costing the Economy Billions

Money laundering and financial fraud is a problem that has become even harder to track with the proliferation of real-time digital transfers and payments, complex international laws and the rise of cryptocurrencies. The United Nations Office of Drug and Crime estimates that money laundering is 2-5% of global GDP (or $800 billion-$2 trillion). Governments across the world have increased regulatory oversight to stop money laundering to the extent that a 2018 survey from LexisNexis estimated that the cost of regulatory compliance for Anti-Money Laundering (AML) for U.S. financial services firms now exceeds $25 billion annually.

Read More

Legacy Approaches to Detecting Money Laundering Are Insufficient

Database for AML?

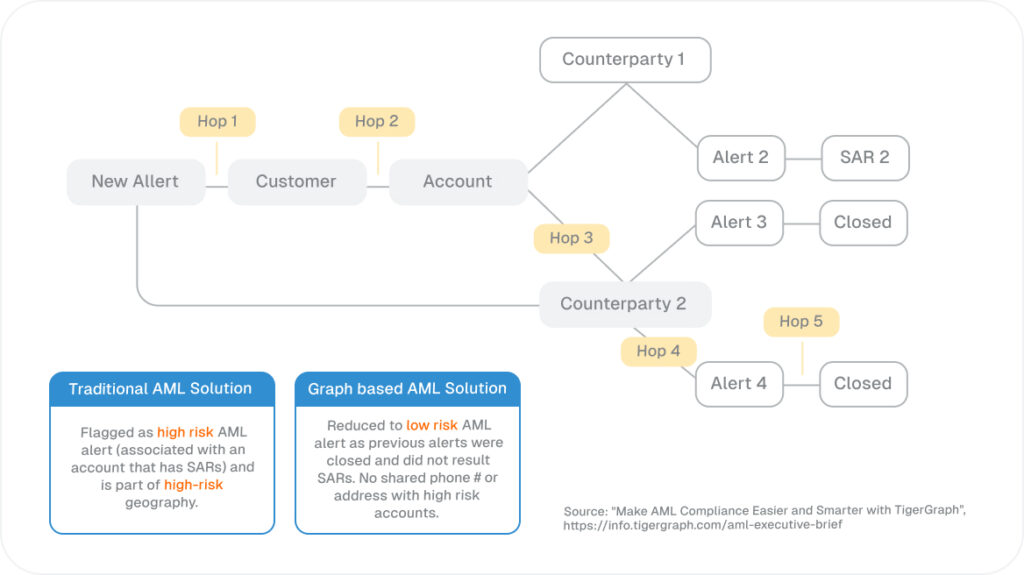

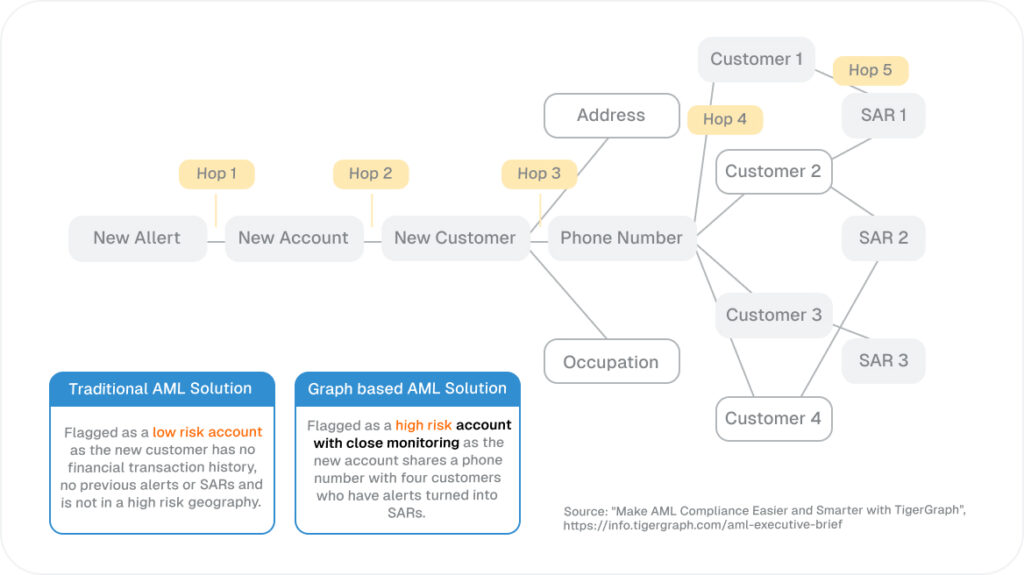

Reduce False Positives With Deep Link Analytics

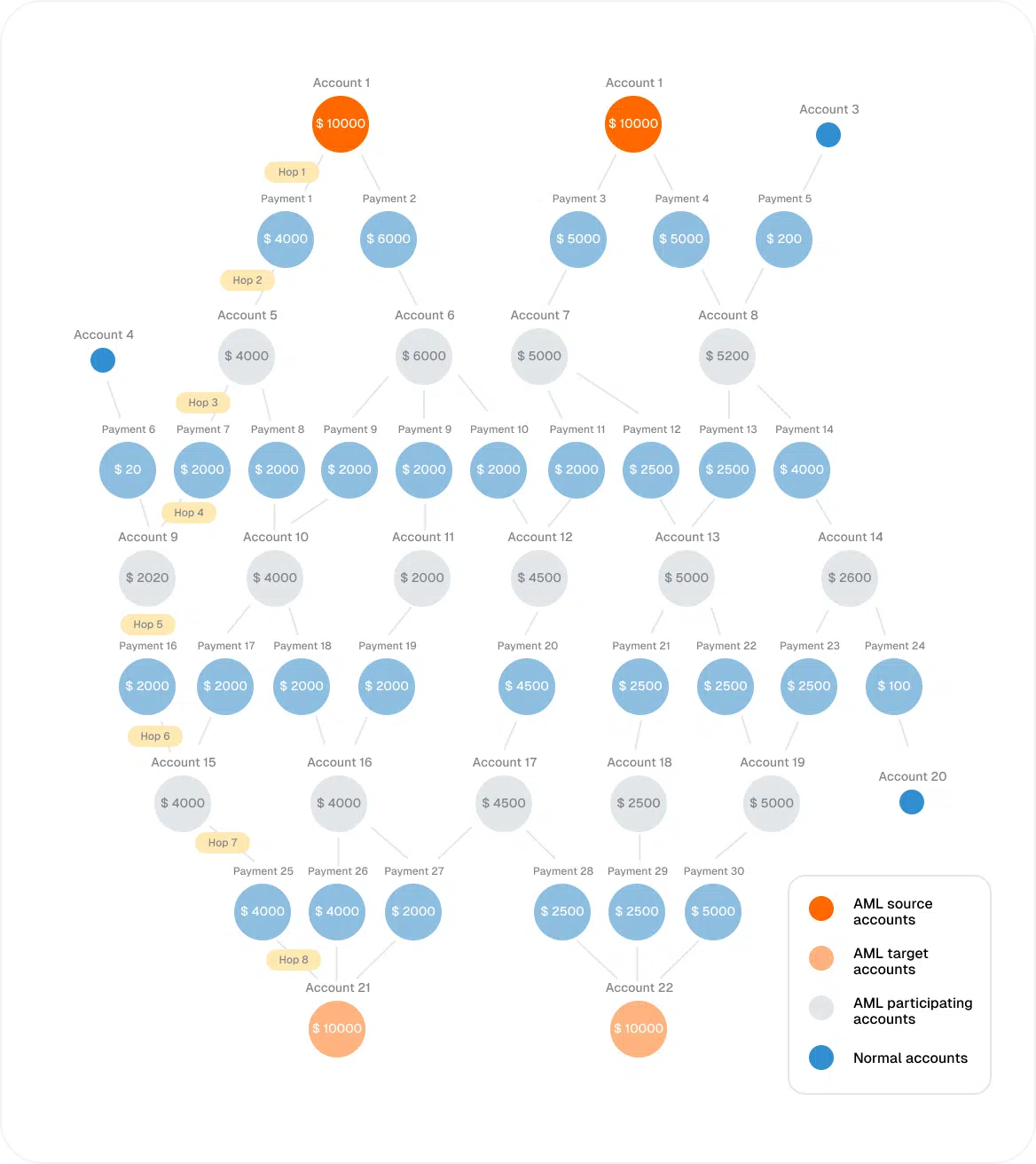

Graph Analytics Can Reduce False Negatives in Money Laundering Detection

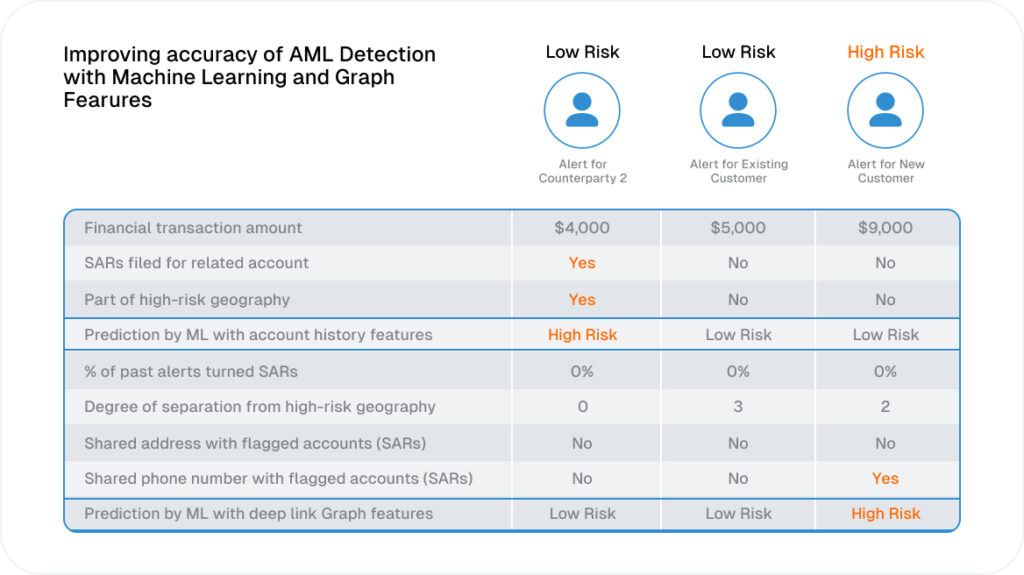

Machine Learning Improves the Accuracy of Money Laundering Detection